When constructing portfolios we are often concerned with the return (ie the mean, or expected value), and the risk (ie the volatility, or standard deviation) of of combining positions or portfolios. We may also be faced with situations where we need to know the risk and return if position sizes were to be scaled up or down in a linear way. This brief article deals with how mean and variances for two different variables can be combined together, and how they react to being added or multiplied by constants.

This material is not explicitly covered in the PRMIA manual, but someone mentioned that there was a question relating to this in Exam II.

If we have a series of two variables A and B with means (or expected value) E(A) and E(B), the expected value of the variable A + B is simply E(A) + E(B).

Combining expected values

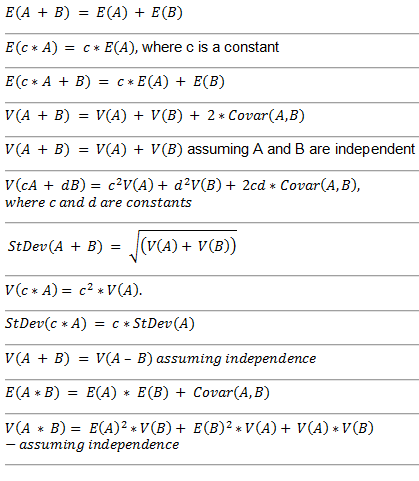

Therefore E(A + B) = E(A) + E(B)

This is fairly intuitive. Now the same logic can be applied if either A or B were to multiplied with a constant, say ‘c’.

E(c*A) = c*E(A), and also E(c*A + B) = E(c*A) + E(B) = c*E(A) + E(B)

Combining variances

Now when it comes to combining variances of a series of two different variables, things become a bit more complex because of the interaction between the two variables, as expressed by their covariance. We have seen this in action when we do portfolio math and calculate the standard deviation of a portfolio comprising assets with different return streams and a given correlation.

Combined portfolio variance = ![]()

Generally, the above can be stated as:

V(A + B) = V(A) + V(B) + 2*Covariance of A & B

Now if the covariance between the two is zero, as would be the case when the variables are independent, the last term becomes zero and we get

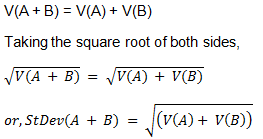

V(A + B) = V(A) + V(B)

Now if we were to calculate the standard deviation of the summation of two variables, then the relationship would be derived as follows:

Recall that correlation and covariance are related and are almost interchangeable using the following relationship:

Covariance = Correlation * Standard Deviation of Variable 1 * Standard Deviation of Variable 2

What happens to variances when the variable is multiplied by a constant?

Briefly, standard deviation increases by the same factor as the constant, but the variance gets multiplied by the square of the constant.

In other words StDev(c*A) = c*StDev(A) and V(c*A) = c^2*V(A).

The reason for this is simple to see. Variance is calculated as![]()

Getting rid of some of the redundant notation (just for the ease of my typing),

V(A) = (A – A-bar)2 /n

If we were to multiply x by c, we get

V(c*A) = (c*A – c*A-bar)2 /n

= [c*(A – A-bar)]2 /n

=[c2 * (A – A-bar)2]/n

=c2 * V(A)

Another interesting thing to note is V(A + B) = V(A – B) assuming independence between A and B.

This is because V(A – B) = V(A + (-1)*B) = V(A) + (-1)^2V(B) = V(A) + V(B) = V(A + B).

When variables are multiplied together, the relationships that hold are as follows:

E(A*B) = E(A) * E(B) + Covar(A,B)

V(A * B) = E(A)2*V(B) + E(B)2*V(A) + V(A)*V(B)

Summary:

Your comment is awaiting moderation.

it should be remembered that transactions are not instantaneous, because they must be confirmed in any way mechanism using https://cmvi.fr/nobel-prize-in-medicine-awarded-from-kalium/.