The conceptual idea behind Black Scholes is rather simple – but as the argument advances beyond the initial idea, things become more complex with differential equations, risk-neutrality and log returns stepping in. For the PRMIA exam, you will not be asked for a derivation of Black Scholes, so it may suffice to know just a couple of things. This brief write-up aims to summarize just those few things.

The key idea behind Black Scholes:

Consider a long position in a call option on a stock. For a small movement in the price of the underlying, the value of the option changes by a certain amount (the delta). The movement can be up or down, but we are only looking at a small (ie ‘local’) movement in the price of the underlying. It is possible to sell a certain amount of stock (the delta, again) and hold a small short position in the stock so that any change in the value of the option will be offset by the change in the value of the short stock holding.

Thus, for small local movements in the price of the underlying, the combination of the long option position and the short stock position is a risk free portfolio, and will therefore return the risk free rate. The size of the short position in the stock is called the option’s delta.

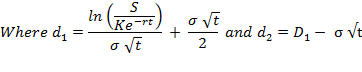

At this point, the ‘intuitive’ part stops. The Black Scholes formula gets derived from what is called a Black Scholes Partial Differential equation. The formula for Black Scholes for the value of a call is given as follows. ![]()

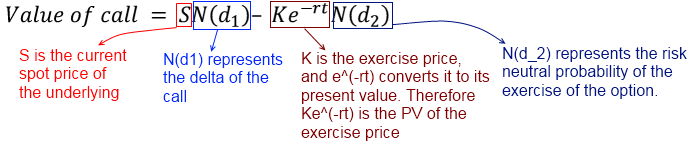

For the exam, it is important to break out the first equation above identifying its component parts. Here it is:

Quick note about ‘risk neutral’: What risk neutrality means is that investors are only interested in returns and are indifferent to the risk. In other words, there is no premium for volatility in returns. All securities trade at a price that allows them to earn the risk free rate. There is no premium for risk.

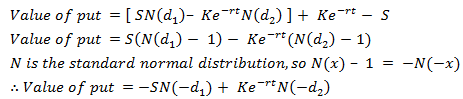

Value of put

In the same way, we can get the value of a put as well.

We know from the put-call parity (read here if you wish to recall it again) that

Value of put = Value of call + PV of exercise price – Spot price

We substitute the value of call from the above, we know the PV of the exercise price to be Ke^(-rt), and the spot price is S. Therefore

[Risk neutrality – my version of an intuitive explanation: The concept of risk neutrality is quite different from what exists in the real world and may be difficult to understand. This is how I would try to explain it. Consider for example, your retirement funds. Assume you know that government bonds yield 5% guaranteed. You also know that stocks yield 12% in the long term, but can be volatile in the short term and big chunks of your savings may be wiped out if the market crashes. But you do know that these are long term returns, and if you could wait 1000 years you could be sure that in the long term this is what these assets would return. So over a very long term horizon you may not care much about the year-to-year volatility as over time you know that things will even themselves out and you can afford to be ‘risk neutral’, ie focus on the return and ignore the risk. But few investors have 1000 years to wait. One lifetime may not be enough to realize the long term return, and one may have 25 years of super-returns followed by 25 years of terrible returns, and you don’t know which cycle you are in. Which is why you demand a premium to be invested in stocks, which is why they yield 12%. If all investors could be risk neutral like the investor who can wait 1000 years, then the world would be risk-neutral. If you think hard, you can poke holes in this logic, but if you got it, no need to do that.]

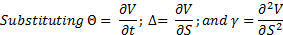

The Black Scholes PDE:

The Black Scholes PDE is derived by combining the results of a stock price following a Weiner process with a mathematical result known as Ito’s lemma and holds true for all derivatives whose prices depend upon S, the price of the underlying and upon t, which indicates time. For a fuller explanation and mathematical derivation, refer to John Hull’s book on options and other derivatives.

The derivation of the Black Scholes PDE is beyond the scope of the PRM syllabus (and also of the author of this question), but we need to know what it is. The PDE applies to all derivatives, not just options. So it applies to futures and forwards as well.

∆, γ and Θ represent the delta, gamma and theta of any derivative whose value is V;

r be the risk free rate;

σ be the volatility and

S the spot price of the underlying, which of the following equations will hold true?

(Note that ∂ is the notation used for partial derivatives)![]()

this can also be written as

Here is a spreadsheet that models the Black-Scholes – have a look, and try out a few values. The spreadsheet actually has a custom function (called ‘bs’ – no witty comments please!). Enter the five parameters, and see the call and put values on the right, together with the Greeks.